In the wake of COVID-19, businesses have either shut their doors, moved to a limited service model or some have even looked to alternative revenue streams, such as drop-off/pick-up business. Regardless of which of these categories you fall into, there is one urgent need that impacts everyone: Cash flow.

“For me, cash is something that is vital to a business,” said Anthony Lambatos of Footers Catering during the March 24th ICA webinar Temporary Shutdown vs Limited Service. “Without cash, you’re dead.”

During the March 24th webinar, Lambatos, who was joined by Jeffrey Selden from Marcia Selden Catering and Margot Jones from Purple Onion Catering, discussed ways to address the need for cash when there isn’t currently any coming in.

How long do you have before your cash runs out?

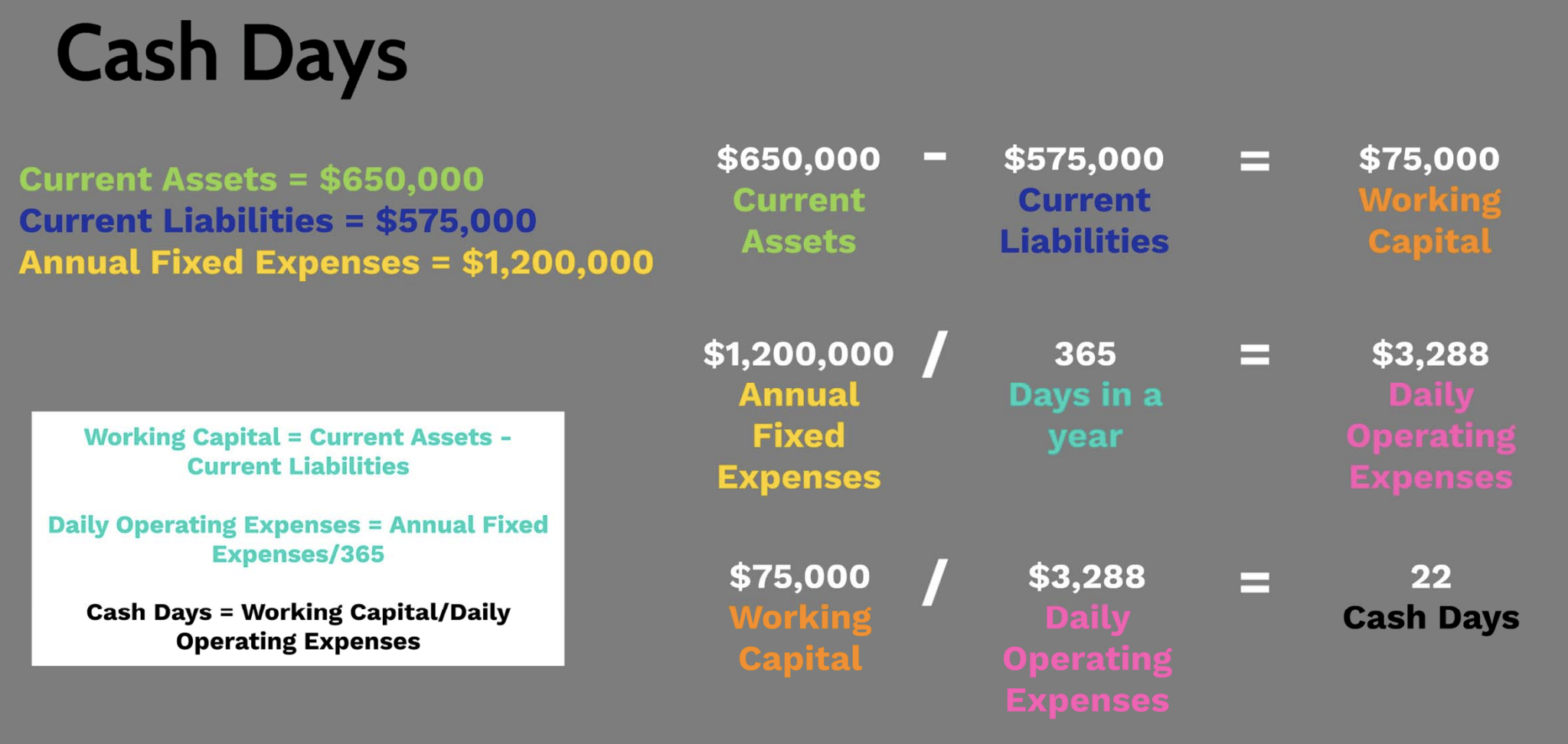

Regardless of your situation, the first step in navigating the current climate is to determine how long you can operate with the current cash you have on hand, Lambatos said. In order to determine how long your cash is going to last, you’ll first need to determine your regular expenses, including your working capital and operating expenses. Once you have determined what you are spending and bringing in on a regular basis, you can use a simple formula to solve for the number of Cash Days you have before you burn through what you have put away. Below is an example of how to identify your Cash Days.

“This should give you a really good understanding of how far that money is going to get you,” Lambatos said during the webinar.

Ways to save your cash

Now that you’ve identified how far your current cash will take you, it’s time to determine where you can cut in order to stretch the cash even further. One option would be to temporarily shut your doors in addition to laying off your employees, which is exactly what Jones did.

“I’m not going to open our company without any cash,” she said during the webinar.

But what if you decide to stay open and retain your employees? There are a number of cost-saving measures you can take, Selden said. For example, in addition to laying off some employees, Marcia Selden Catering also decreased their salaried employees to a three-day work week in addition to cutting their salaries by 40%.

But what if you decide to stay open and retain your employees? There are a number of cost-saving measures you can take, Selden said. For example, in addition to laying off some employees, Marcia Selden Catering also decreased their salaried employees to a three-day work week in addition to cutting their salaries by 40%.

Selden said they are also offering an incentive for events that have been rescheduled to pay up front by offering significant discounts.

It’s also important to think about the additional expenses you have, such as rent, gas, electricity, cable and telephone. Marcia Selden Catering was able to negotiate payment extensions for these services.

“They seem so obvious,” Selden said during the webinar, “but you just have to make the call.”

For Jones, she went through and cut almost all of the expenses that she won’t be needing, including:

- Payroll services

- Pest control

- Grease trap cleanings

- Fleet management software

- Preventive maintenance on HVAC

- Hood cleaning

- Hood inspection

- Dish machine maintenance

- Knife sharpening services

- Business email services

- Online storage subscriptions

- Wedding listings

- Telephone services

- Internet services

- Floorplan design online services

- Online staffing services

- Receipt and expense management software services

- Online planning services

- Stock image subscription

- Eblast marketing subscription

Jones also recommended checking on loan repayments or mortgages to see if those payments can be delayed.

“You need to go through everything you could possibly think of to get your costs under control,” she said during the webinar. “If you don’t need them, get rid of them because it really adds up.”

Get the latest on COVID-19 here.

One tactic that should be avoided, or approached with caution, is using current event deposits to help pay for outstanding expenses.

“At the end of the day, that’s money you owe somebody else,” Lambatos said during the webinar. “Yes these are desperate times, but that’s a risky thing to do as a last resort.”

It’s difficult to know what will happen from one day to the next, Lambatos said, but all you can do is make adjustments now in hopes that you will see your business return.

“A part of me thinks that this is a slingshot that comes straight back and once this dissipates people are excited to be partying again,” he said. “But on the other side everyone could be hesitant to be part of large crowds, and it’s difficult to say which way it’s going to go.”

Jones said the best solution is to focus on what you can control now.

“It’s time to think about what’s important now,” she said. “Your business will hopefully come back, I didn’t work 30 years for this to go under, so now you just have to take care of yourself and your family.”